Why Generic Drug Coverage Matters When You Switch Health Plans

When you switch health plans, the biggest surprise isn’t always the monthly premium. It’s the cost of your monthly pills. A drug you paid $5 for last year could suddenly cost $40 - not because it changed, but because your new plan put it in a higher tier. Generic drugs make up 90% of all prescriptions filled in the U.S., yet most people don’t check if their specific meds are covered the same way under a new plan. That’s a mistake that can cost hundreds - or thousands - a year.

How Formularies Work: The Hidden Rules That Control Your Costs

Every health plan has a formulary - a list of drugs it covers, sorted into tiers. The lower the tier, the less you pay. Tier 1 is almost always for generic drugs. But not all generics are treated the same. Some plans put certain generics in Tier 1, others in Tier 2 - even if they contain the exact same active ingredient. For example, metformin made by Manufacturer A might be a $3 copay, while metformin from Manufacturer B is a $25 copay. Both are generic. Both work the same. But your plan doesn’t care - it only cares which brand it’s contracted with.

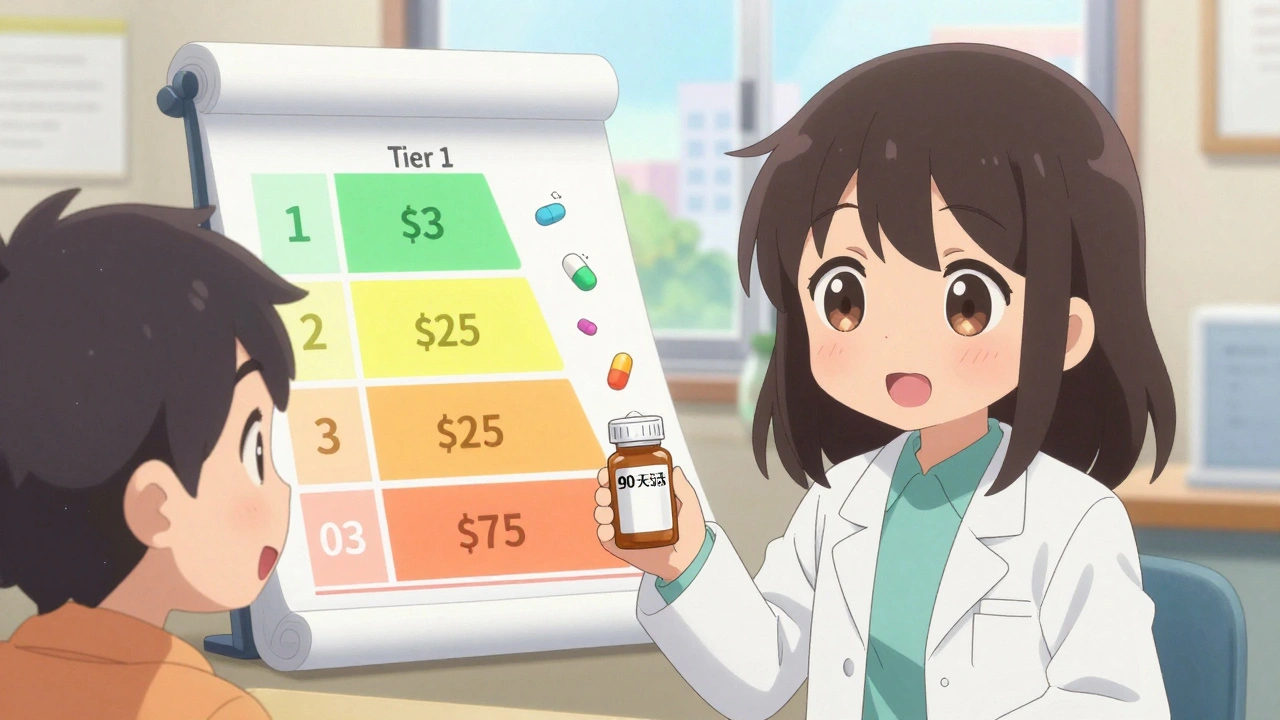

Most plans use 3 to 5 tiers:

- Tier 1: Preferred generics - lowest cost, usually $3-$20 for a 30-day supply.

- Tier 2: Non-preferred generics or brand-name drugs with generic alternatives - $20-$50.

- Tier 3: Non-preferred brand-name drugs - $50-$100.

- Tier 4/5: Specialty drugs - often over $100, sometimes a percentage of the price.

Medicare Part D and marketplace plans follow federal rules, but employer plans and some state-specific plans can vary wildly. In New York, many plans waive the deductible for Tier 1 generics entirely. In California, you pay an $85 deductible first - then 20% coinsurance. That’s a big difference if you take three generics a month.

How Deductibles Change Everything - Even for Generics

Some plans combine your medical and prescription deductibles. That means you have to pay $1,500 or more out of pocket before your drug coverage kicks in - even for a $5 generic. Other plans, especially Silver Standardized Plans on the marketplace, waive the deductible for Tier 1 generics. You pay a flat $20 copay, no matter what else you’ve spent.

If you take regular medications, a plan with a high deductible and no exception for generics can cost you $1,500 more a year than a plan that covers your pills right away. One woman in Ohio switched to a plan with a $3,000 deductible and didn’t realize her $12-a-month blood pressure med wouldn’t be covered until she hit $3,000 in spending. She ended up paying $144 out of pocket that year - instead of $144 total over 12 months.

What You Must Check Before You Switch

Don’t rely on a plan’s summary. You need the full formulary - the complete list of covered drugs and their tiers. Here’s exactly what to do:

- Get your current list: Write down every medication you take - including the exact name, strength, and how often you take it (e.g., metformin 500mg, once daily).

- Find the new plan’s formulary: Go to the insurer’s website. Look for “Drug List,” “Formulary,” or “Prescription Benefits.” Don’t trust the summary page - download the full PDF.

- Search by drug name: Type in each drug. Check the tier and any restrictions (like prior authorization or step therapy).

- Check the manufacturer: If your current generic is made by Teva, but the new plan only covers the same drug made by Mylan, you might get stuck with a higher tier. Ask: “Is this exact formulation covered?”

- Check your pharmacy: Your local pharmacy might not be in-network. Using an out-of-network pharmacy can triple your cost - even for a Tier 1 drug.

- Use a cost calculator: Use Medicare.gov’s Plan Finder or Healthcare.gov’s tool. Enter your drugs, zip code, and preferred pharmacy. It will show you estimated annual costs for each plan.

People who do all six steps reduce unexpected drug costs by 73%, according to CMS data. Those who skip even one step often end up paying more.

Real Examples: How Generic Switches Cost People Money

One user on Reddit switched plans and thought her levothyroxine (a thyroid med) would stay at $0. Her old plan covered it as a preferred generic. Her new plan listed it as a non-preferred generic - $45 a month. Same drug. Same dose. Different manufacturer. She didn’t check.

Another person in Florida switched to a Medicare Advantage plan that covered his diabetes meds - until the plan changed its formulary mid-year. His generic metformin moved from Tier 1 to Tier 2. His monthly cost jumped from $5 to $35. He didn’t get a notice. He only found out when he went to refill.

On the flip side, a woman in Massachusetts switched from a high-deductible plan to a Silver SPD plan. Her three generics - metformin, lisinopril, and atorvastatin - went from $400 a year in out-of-pocket costs to $36. She saved $364. She did her homework.

What’s Changing in 2025 - And How It Affects You

The Inflation Reduction Act is making big changes. Starting in 2025, Medicare Part D will cap out-of-pocket drug spending at $2,000 a year. That’s huge for people on multiple meds. Also, insulin will be capped at $35 a month - no matter your plan.

But there’s a catch: Medicare is splitting Tier 1 into two parts - “preferred generics” and “non-preferred generics.” That means even your cheapest drugs might get bumped up. Plans will have more tiers, more complexity, and more chances for confusion.

Meanwhile, 32 states now offer Silver Standardized Plans with $10 copays for Tier 1 generics - no deductible. That’s a win for people on fixed incomes. But if you’re in a state that doesn’t offer it, you’re stuck with the old rules.

Top Mistakes People Make When Switching

- Assuming all generics are equal. They’re not. Formularies pick which brands they like.

- Not checking pharmacy networks. Your CVS might be in-network. The pharmacy next door isn’t. You pay triple.

- Ignoring mail-order options. Some plans offer 90-day supplies for the same price as 30-day. That’s a 30% savings.

- Believing the plan’s website is accurate. Many tools show outdated info. Always download the official formulary PDF.

- Waiting until open enrollment. If you switch mid-year (due to job loss, divorce, etc.), you don’t get a second chance. Check now.

What to Do If Your Drug Isn’t Covered

If your generic isn’t on the formulary, or it’s in a high tier, you have options:

- Ask your doctor for an exception: Many plans allow you to request a formulary exception if your drug is medically necessary. Submit a letter from your doctor.

- Ask for a therapeutic alternative: Can you switch to a similar generic that’s covered? Your pharmacist can help.

- Use a patient assistance program: Many drug manufacturers offer free or low-cost meds for low-income patients. Check NeedyMeds.org.

- Wait for next year’s plan: Formularies change every January. The plan you hate this year might be better next year.

Final Tip: Track Your Costs Year-Round

Don’t wait for open enrollment to check your drug costs. Every time you refill, write down what you paid. At the end of the year, add it up. Compare that to what you’d have paid under other plans. You’ll know exactly which plan saved you money - and which one cost you more.

Generic drugs are the most affordable way to manage chronic conditions. But only if your plan lets you use them affordably. Don’t assume. Don’t guess. Check. Every time you switch.

Are all generic drugs covered the same under every health plan?

No. Even if two generics have the same active ingredient, one might be in Tier 1 (low cost) and the other in Tier 2 (higher cost) depending on which manufacturer your plan has a contract with. Always check the exact drug name and manufacturer on the plan’s formulary.

Do I have to meet my deductible before generic drugs are covered?

It depends. Some plans waive the deductible for Tier 1 generics - you pay a flat copay. Others require you to meet your full medical and prescription deductible first. Silver Standardized Plans on the marketplace typically waive the deductible for generics. High-deductible plans usually don’t. Check the plan’s formulary details.

Can I switch to a different generic if my current one isn’t covered?

Yes - but only if your doctor agrees. Many generic versions of the same drug are interchangeable. Ask your pharmacist or doctor if there’s another brand of your medication that’s covered under your plan’s Tier 1. Sometimes, a simple switch saves you hundreds.

Why does my pharmacy charge more for my generic than the plan says?

Your pharmacy might not be in-network. Many plans have preferred pharmacies that offer lower prices. If you use an out-of-network pharmacy, you could pay 300-400% more. Always confirm your pharmacy is in-network before filling a prescription.

What should I do if my plan changes its formulary mid-year?

You can request a formulary exception from your insurer - especially if your drug is essential for your health. You’ll need a letter from your doctor explaining why you need that specific medication. Some insurers also offer a 30-day transition supply if they remove a drug from coverage. Don’t stop taking your medication - act quickly.

Comments

I just realized my $3 metformin turned into $40 because my plan switched manufacturers 😭 I didn’t even get a notice. Now I’m scared to refill anything. 🤯

This is why I always print out my formulary and keep it in my wallet. People think generics are interchangeable, but the system is rigged to make you pay more if you don’t know the fine print. You’re not being paranoid-you’re being prepared.

omg i just checked my plan and my lisinopril went from tier 1 to tier 2?? i think i need to cry in the pharmacy aisle 😭😭😭

The structural inequities embedded in pharmaceutical formularies are a direct consequence of market-driven healthcare policy. The assumption that all bioequivalent generics are functionally identical is a dangerous oversimplification. Insurers negotiate contracts with manufacturers based on rebate structures, not therapeutic outcomes. Consequently, patients are subjected to arbitrary tiering that prioritizes corporate profitability over clinical necessity.

In India, generics are so cheap we don’t even think about tiers. But here? You’re basically gambling with your health. I’ve seen people skip doses because they can’t afford the $50 copay on a drug that costs $2 in Delhi. It’s not healthcare-it’s a lottery.

Your entire argument rests on the flawed premise that formularies are the problem. The real issue is the overprescription of chronic medications in the first place. If people stopped treating every minor fluctuation with a pill, we wouldn’t need these complex systems. Your solution is band-aid economics.

I used to think this was just me being bad at paperwork. Turns out, it’s a system designed to confuse. I saved $400 last year just by switching to mail-order for my statin. No one tells you this stuff. Thanks for the clarity, friend.

I’ve been a nurse for 18 years. I’ve watched patients cry because they can’t afford their blood pressure meds. The formulary system isn’t broken-it was built this way. The only way to fight it is to demand transparency, document every cost, and push back with your provider. You’re not alone. I’ve filed over 30 exceptions for patients. It’s exhausting, but it works.

lol you think this is bad? wait till you find out the FDA lets the same pill be made by 12 different companies and they all charge different prices because the gov't lets 'em. also, your pharmacy? owned by the same corp that runs your insurance. they want you to suffer. 🤡